The role of the CPA has significantly evolved over the past several years. In turn, the CPA Exam must change to reflect the current and future skills, competencies and knowledge of technology required of a newly licensed CPA. Enter the 2024 CPA Exam Evolution. A joint initiative between the AICPA and NASBA that is transforming the CPA licensure model.

What does this mean for your new hire and uncertified staff that are CPA candidates? Beginning January 2024, they will be testing under the Core + Discipline model. Our goal is to help you understand these changes and how you can support your staff by tracking their CPA Exam completion with LCvista.

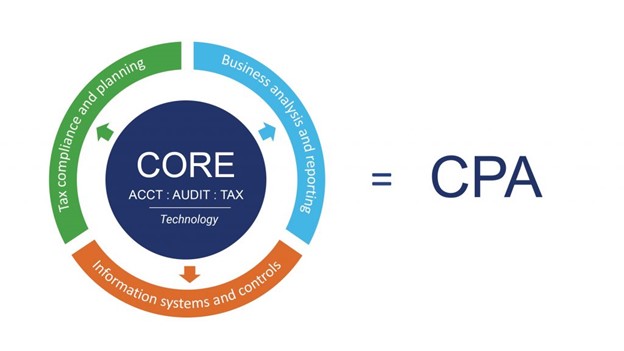

Core-Plus-Discipline Model

Image source: AICPA

The proposed licensure model is based on review of feedback from thousands of stakeholders across the profession. Candidates will be required to have a deep understanding and a strong core in Accounting, Auditing and Tax with technology immersed throughout. From there, each candidate will have a choice of disciplines that reflect the pillars of the CPA profession: Business Analysis and Reporting, Tax Compliance and Planning, or Information Systems and Controls. Regardless of which discipline they choose, there is still only one full CPA license. They will not be limited to the practice area of the discipline they choose for testing.

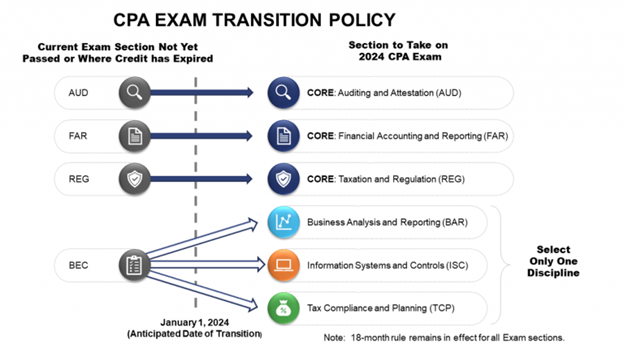

CPA candidates will still have 18 months from the date they pass their first exam to complete all 4 sections of the Core + Discipline model. In late February, the AICPA and NASBA released a transition policy for those who will begin their testing under the current model but are expected to complete testing after January 2024 under the new model. Credits received for FAR, AUD, and REG will transition to the corresponding sections of the Core. BEC will transition to one of the 3 disciplines. The transition should cause as little disruption as possible.

Image Source: NASBA

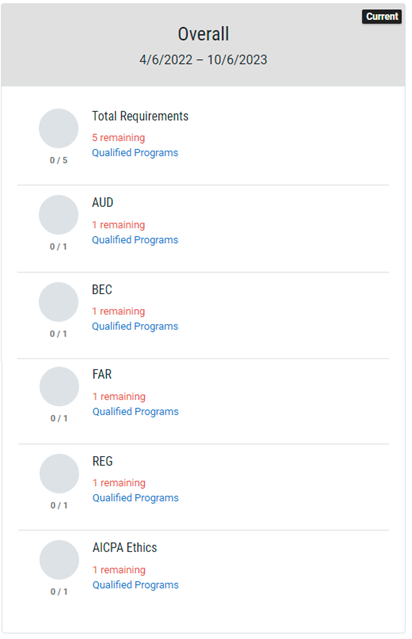

You have the opportunity to support your uncertified staff by allowing them to easily track their CPA Exam progress and completion with LCvista. Our CPE compliance system has a CPA Exam jurisdiction that allows the user to select which jurisdiction they’ll be applying for a CPA license in. As users complete Exam parts, they can indicate it in the system to ensure that all parts are done within the 18-month window.

If a specific state/jurisdiction is selected, the system will display the Exam parts required for that specific state along with any applicable Ethics requirement. It will also specify if the requirement is the AICPA Ethics Exam or a State-specific Ethics Exam. As with all jurisdictions, our configuration allows for us to add/edit rules and requirements as things change. We are confident that you and your staff can continue to easily track CPA Exam completion as we move to the CPA Exam Evolution.

LCvista is constantly monitoring upcoming rule updates and consulting with our client community on the best ways to support their staff in navigating changes. Whether you are a current client or not, do not hesitate to reach out to our team. We are happy to consult on continuing education related topics and always welcome feedback from the accounting industry.